Flawed Approach: The Working Families Tax Cut Act as a Response to Inflation

Earlier this week, Congresswomen Nicole Malliotakis (R-NY) and Michelle Steel (R-CA), who are both members of the House Committee on Ways and Means, introduced the Working Families Tax Cut Act. The bill would temporarily increase the standard deduction by $2,000 for single filers and $4,000 for married filers in 2024 and 2025. However, this increase would phase out for taxpayers with incomes over $200,000 ($400,000 for married couples filing jointly).

According to a committee press release, the bill aims to address the burden of high and sustained inflation resulting from pandemic-related fiscal stimulus and accommodative monetary policy by the Federal Reserve on middle-class families. “Americans can no longer keep up with price increases, which is why we’ve introduced this legislation to increase the standard deduction and allow millions of families to keep more of their hard-earned money,” noted Malliotakis.

While inflation has adversely affected households and the US economy as a whole, a temporary expansion of the standard deduction is a poorly designed policy response for several reasons.

First, any policy that increases household disposable income will contradict efforts to mitigate rising prices by increasing aggregate demand. Current monetary policy is attempting to slow aggregate demand by raising interest rates, and a policy that increases the deficit would further counter that effort.

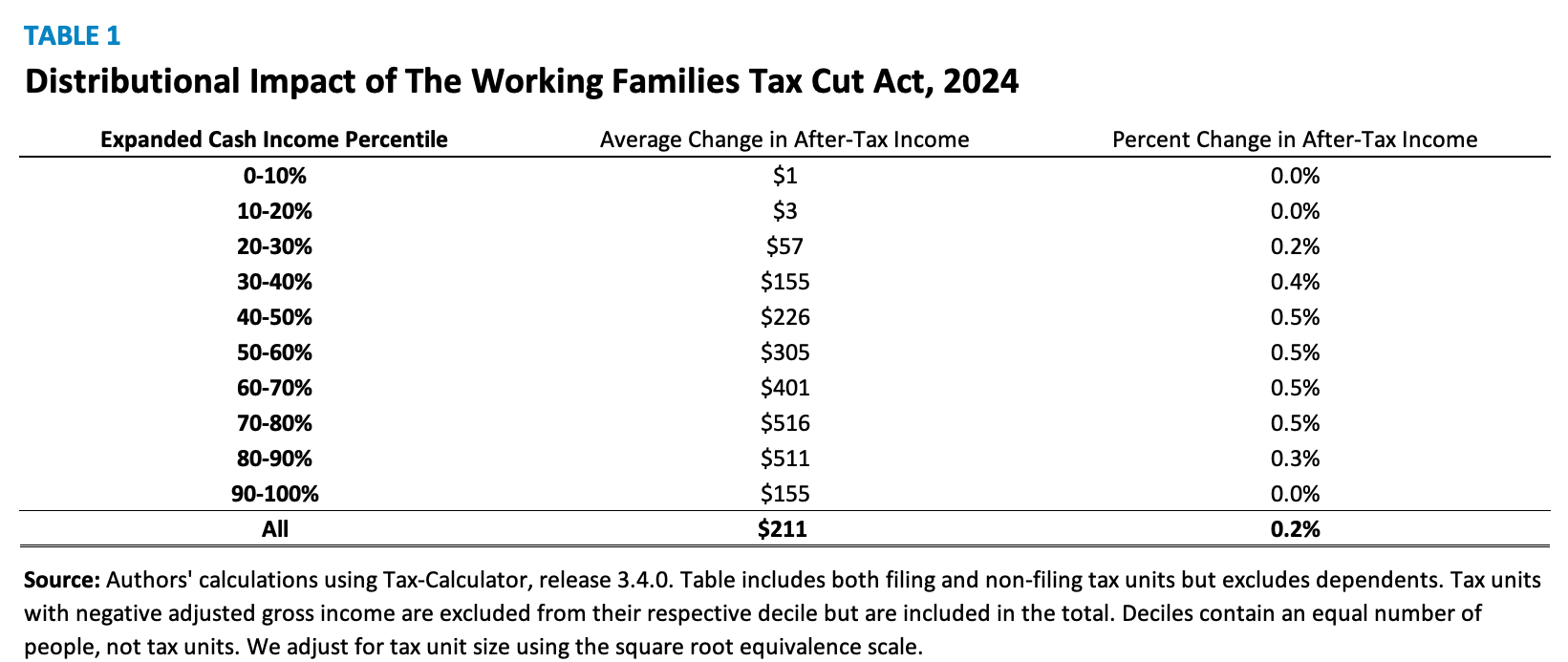

Second, the policy is poorly targeted. As illustrated in the table below, the Working Families Tax Cut Act would provide little to no tax relief for taxpayers in the lowest two income deciles, who already have little to no taxable income. The largest benefits would go to middle- to upper-middle-income households. Moreover, the timing of the policy is ill-fitted to address current inflation concerns. The bill would take effect next year when inflation is high this year. By 2025, inflation is expected to have abated, with forecasters predicting annual-average headline CPI inflation of 2.4 percent.

Third, the policy would be costly. We estimate the static revenue cost in 2024 to be $43 billion, with a two-year cost of $88 billion. If lawmakers extend this policy alongside the individual income tax provisions of the 2017 Tax Cuts and Jobs Act (TCJA), the extension of those provisions would cost an additional $422 billion.

In 2024, as a result of the Working Families Tax Cut Act, we estimate 4.1 million fewer filers would itemize. This may be seen as a valuable tax simplification by some, but it is worth noting that it would reduce the value of itemized deductions such as the state and local tax deduction, charitable contribution deduction, and home mortgage interest deduction.

For such a costly policy, this proposal would have very little impact on work incentives. We estimate that only 15.8 million (7.5 percent) taxpayers would face a lower marginal tax rate, as they are shifted into lower tax brackets. Meanwhile, 6.7 million (3.2 percent) high-income households would face a slightly higher marginal rate due to the phase-out of the bonus standard deduction.

Instead of proposing new temporary tax breaks that are costly and ineffective, Congress should focus on addressing existing temporary tax policies. Most individual income tax provisions in the Republican tax reforms enacted in TCJA, for example, are set to expire at the end of 2025. Leaving this large cliff unresolved could have potentially disruptive effects on taxpayers and the economy.

This article first appeared on June 8, 2023 at AEIdeas. AEIdeas is a publication of the American Enterprise Institute (AEI).